Our philosophy at Statewide Retirement Planning Co. is to work with our clients through education and information. We feel strongly that this approach will enable our clients to make better and more informed decisions. With this in mind, we have decided to send out a regular newsletter filled with information regarding all aspects of retirement and the retirement planning process. We hope that you enjoy reading these newsletters and are able to use the information to make your retirement years more secure and enjoyable than it otherwise might be.

Please feel free to forward copies to your family and friends.

ARE YOU AWARE?

Things to consider in Estate Planning

Under current law, the estate tax exemption is set at $5,000,000. Are you aware that unless congress intercedes, this law sunsets at the end of this year….2012, and that the exemptions revert back to the 2001 level of $1,000,000. If your net worth (at death) is greater than $1,000,000, this may necessate the need for Estate Planning. While you should always seek guidance from an estate planning attorney, here are a few things that may help to minimize the tax burden:

|

Wills - Make sure that your will is up to date….and make sure it has an AB Trust (there are different names for this) inside the will. This provision allows the exemption from a deceased spouse to pass to the surviving spouse…if this is not in the will, the surviving spouse would lose their deceased spouse’s exemption. |

|

Gifting – If you would like to pass assets to your beneficiaries early while you are still alive. The husband and wife can each gift up to $13,000 to each child ($26,000 to each child) per year. Gifting can help reduce the size of the estate. |

|

Insurance Policies – This is critical. The death benefit of an insurance policy owned by an individual is counted as part of the value of the individual’s estate. Say your estate value totals $1,750,000 and husband and wife each own a life insurance policy of $1,000,000. When they pass away, the value of the estate would be $3,750,000. Subtract their exemption allowance of $2,000,000 ($1 million each) and the amount subject to estate taxes is $1,750,000. A graduated estate tax (a conservative value is 35%) would apply to this figure. That represents a tax bill of $612,500.

Solution: Have an ILIT (Irrevocable Life Insurance Trust) own the policies. The death benefit would then be held outside of the estate (not counted as part of it), thus lowering the value of the estate to $1,750,000. NO estate tax applies and the proceeds of the life insurance pass to the beneficiaries tax-free! |

|

Qualified Retirement plans and Annuities - DID YOU KNOW- While qualified retirement plans and annuities are excellent wealth building tools, are you aware that they are taxed at ordinary income at death to the beneficiaries. So here is an insidious fact of taxation…if your client is over the estate tax exemption….qualified retirement plans and annuities in their estate would not only be taxed at ordinary income, but the estate tax would also apply to those investments. |

|

Long Term Care - This is an area often overlooked, but it should be an important piece of the plan. Why? Ask someone who had a parent that needed LTC…they would tell you how fast it depleted their assets. Traditional LTC insurance could be the answer, but for people with assets, the new Asset Based LTC products are a popular choice that should be considered. |

Call us now at (954) 781-2220 or fill out this short survey to find out more about how you might receive guaranteed* income for life and protect your principal at the same time!

|

Call Statewide Retirement Planning Co. at (954) 781-2220 or Fill out the short survey HERE. That will put you in touch with a licensed advisor who specializes in retirement income planning.

-

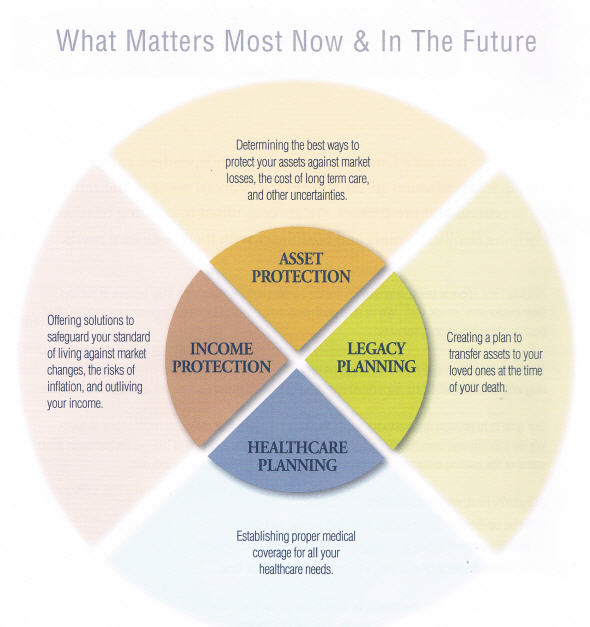

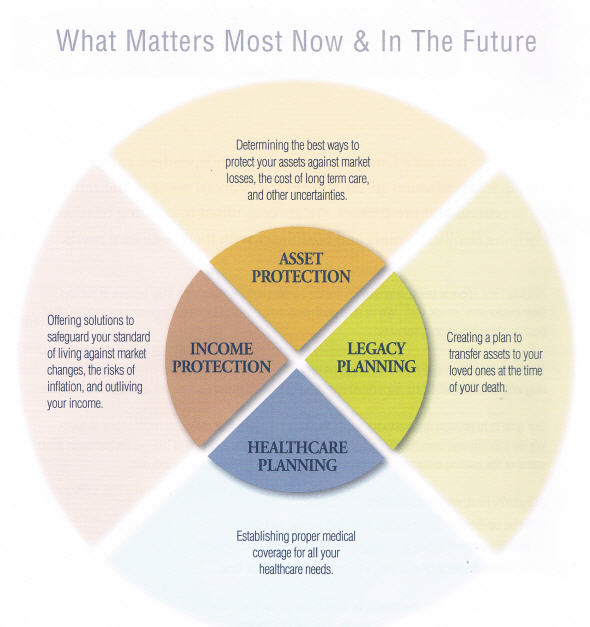

ASSET PROTECTION

-

INCOME PROTECTION

-

LEGACY PLANNING

-

HEALTHCARE PLANNING

|

* Annuity guarantees rely on the financial strength and claims-paying ability of the issuing insurer. |